Bitcoin: the asset that makes your heart race faster than a rollercoaster.

On December 16th, Bitcoin surpassed the jaw-dropping: €100,000 milestone. A few days later, it nosedived like a bird forgetting how to fly. So, what caused this wild ride, and more importantly, will Bitcoin soar past €100,000 again, or are we headed for a deeper crash? Let’s dive into the drama, the data, and the debates.

Why Bitcoin Reached €100,000

-

-

- Regulatory Overreach: If governments implement draconian measures against crypto, Bitcoin’s price could suffer significantly.

- Macroeconomic Factors: A global recession or deflationary trends could reduce risk appetite, leading to further sell-offs.

How Low Could It Go?

If Bitcoin’s downward momentum continues, analysts speculate it could retest levels between €40,000 and €50,000. In a worst-case scenario, prices might briefly dip below €30,000 before stabilizing.

Final Thoughts

Bitcoin’s journey to €100,000 is a testament to its allure and volatility. Whether it’s your golden goose or a ticking time bomb depends on how you navigate the risks. Buckle up because this ride is far from over!

One thing is clear: no one has ever lost money holding Bitcoin for more than four years. This remarkable track record underscores its resilience and long-term potential. With history as a guide, Bitcoin continues to prove itself as a transformative asset in an ever-changing financial landscape.

Looking ahead, almost every factor appears to favor Bitcoin’s trajectory going even higher. From increasing institutional adoption and advancements in blockchain technology to the growing recognition of Bitcoin as a hedge against inflation, the potential for upward momentum is undeniable. As the global financial landscape continues to evolve, Bitcoin stands out as a transformative asset with the power to redefine the way we think about money and value. The €100,000 milestone could be just the beginning of an extraordinary upward journey.

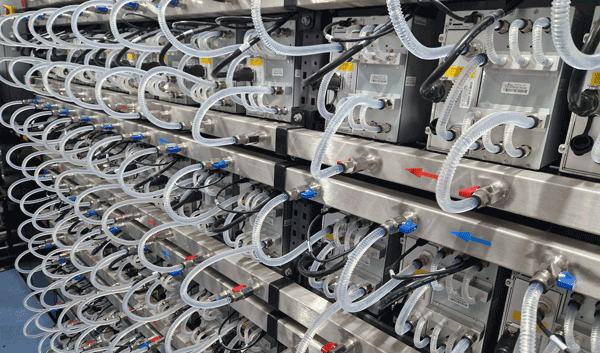

If you want to earn passive income or help decentralize the blockchain in a sustainable way, contact us. Take the next step toward becoming part of the future of finance!