10 Things Crypto Miners Should Not Do in a Bear Market

Bitcoin bear markets tend to separate short-term speculation from long-term conviction. For miners, these periods are less about excitement and more about discipline, cost awareness, and strategic positioning.

If you view Bitcoin as a long-term alternative to fiat and mining as a form of productive exposure rather than speculation, avoiding the following mistakes is essential.

1. Do Not Base Decisions on Short-Term Price Expectations

Bear markets often trigger the temptation to “wait for the bounce” or assume that recovery is just around the corner.

Experienced miners avoid making operational decisions based on price forecasts. Instead, they plan for scenarios where prices remain lower for longer protecting capital and preserving optionality.

2. Do Not Treat Electricity as a Secondary Cost

Electricity is not a background expense, it is the core cost of Bitcoin mining.

Research from the Cambridge Bitcoin Electricity Consumption Index shows that miners with efficient and predictable energy pricing are generally more resilient during market downturns.

During bear markets, many miners choose to turn off their machines when Bitcoin prices fall. While this can be necessary in high-cost environments, it is not always the most rational decision.

Bitcoin mining is, at its core, an energy-driven industry. If your miners are already deployed, your infrastructure is in place, and your electricity price remains stable, turning machines off does not change the cost of energy itself, it only stops production.

For miners operating with competitive and predictable power pricing, continuing to run can allow them to:

Produce Bitcoin at a known and controlled cost

Accumulate rewards during periods of lower network competition

Hold mined Bitcoin with a long-term view

If and when market conditions improve, Bitcoin mined during downturns can contribute meaningfully to long-term returns.

That said, this approach only makes sense when energy costs remain competitive and liquidity is sufficient. Locking into inflexible or above-market power rates can quickly turn a manageable bear market into an operational risk, especially if electricity prices rise while Bitcoin prices fall.

3. Do Not Expand Hashrate Without Stress-Testing the Numbers

More hashrate only makes sense if the underlying assumptions hold under pressure.

Before expanding, miners should model:

- Break-even price under conservative assumptions

- Difficulty increases independent of price

- Long-term operational overhead

Bear markets reward operations that expand selectively, not aggressively.

4. Do Not Buy Hardware Based on Price Alone

Lower ASIC prices can look attractive in a downturn, but cheap hardware is not always efficient hardware.

Data from ASIC Miner Value shows that machines with poor energy efficiency are often the first to fall out of profitability when difficulty rises.

Efficiency and longevity matter more than entry price.

5. Do Not Underestimate Liquidity Requirements

Many mining operations fail for a simple reason: insufficient cash reserves.

Public miners such as CleanSpark have publicly highlighted the importance of liquidity management during bear markets, prioritizing survival over expansion.

Miners should assume:

- Longer payback periods

- Temporary negative margins

- Unexpected infrastructure or maintenance costs

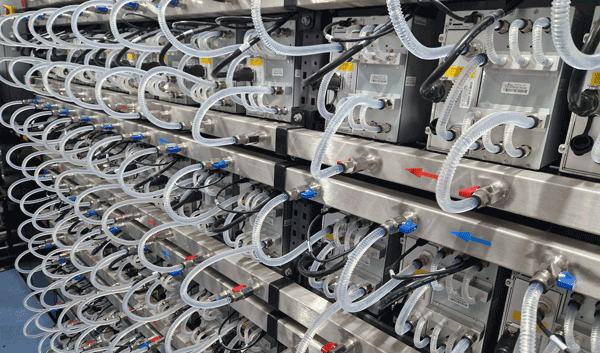

6. Do Not Operate Without Clear Monitoring and Transparency

In tight margin environments, small inefficiencies add up quickly.

A lack of real-time monitoring often results in:

- Undetected downtime

- Reduced effective hashrate

- Higher operational risk

Professional mining operations prioritize transparency and measurable performance over assumptions.

7. Do Not Choose Hosting Based Solely on the Lowest Price

Low headline pricing often hides trade-offs in uptime, support, or contractual clarity.

For miners who prefer operational stability over short-term savings, professional hosting providers.

At Hamus Hosting we are focusing on predictable infrastructure, clear agreements, and long-term reliability.

8. Do Not Ignore Network Difficulty and Hashrate Trends

Bitcoin mining is not only a price-driven business.

Network difficulty often continues to increase even during extended price downturns, placing additional pressure on inefficient operations.

Miners who track difficulty trends make better long-term decisions.

Mining difficulty just dropped by 11%. The biggest move since China’s mining ban in 2021.

Learn more about it on our latest Linkedin post below.

9. Do Not Overleverage or Rely on Debt-Fueled Growth

Leverage can amplify returns and losses.

Several public mining companies have emphasized balance-sheet discipline and operational efficiency during downturns.

Mining is a capital-intensive business. Preserving flexibility matters more than aggressive growth.

10. Do Not Lose Sight of the Long-Term Thesis

For many miners, Bitcoin represents:

- An alternative to fiat systems

- A long-term store of value

- A hedge against monetary expansion

Bear markets test conviction, but they also create the conditions where disciplined operators quietly strengthen their position.